Join the Revolution.

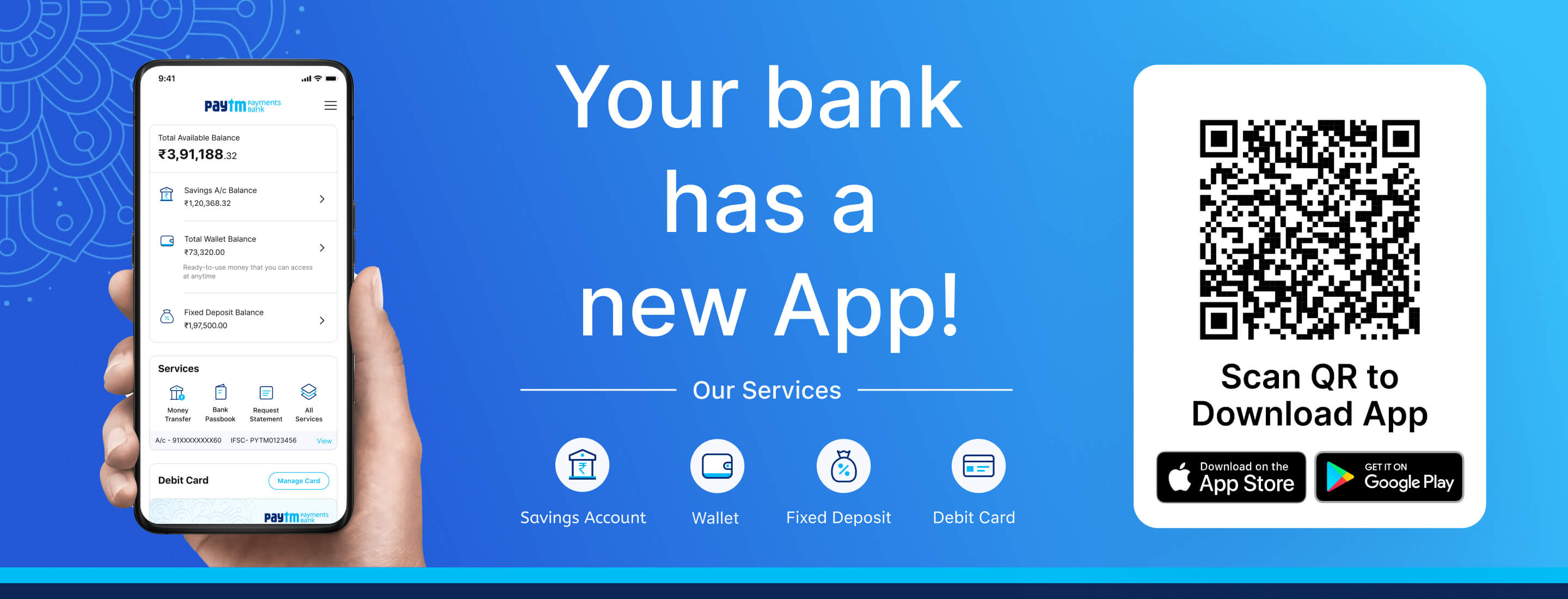

Start your Digital Savings Account today!

Paytm Payments Bank offers a Savings Account with no account opening charges or minimum balance requirements. Keep upto Rs. 2 lac of deposits and enjoy benefits like:

No account fees and charges

Enjoy the convenience of banking on your phone and no charges for online transactions

Risk-free deposits

Your money is safe with us. We invest deposits only in government bonds. None of your deposits will be converted in to risky assets.

VISA Debit Card

Use your free virtual card to make online purchases across all merchants accepting VISA cards. You can order a physical debit card through the Paytm Payments Bank section of your Paytm App

Earn interest every month

Earn an interest of 2% per annum, payable monthly effective 1st August,2023

Real time updated Passbook

View your transaction and balance in real time in Passbook

Highly Secure

Your account is secured with a special Passcode to ensure your account is safe